How to trade in the stock market using a demat account?

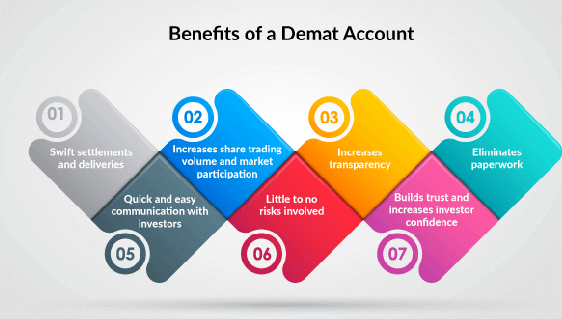

A demat account is an essential tool for investors who want to trade in the stock market. It offers a secure and convenient way to store and manage securities electronically. In this guide, we will take you step by step through the process of stock trading with a demat account. Check the demat account kya hai here.

Step 1: Open a demat account

If you have not already paid so far, the first step is to open a demat account with a registered Depository Participant (DP). Choose a DP that offers an intuitive online trading platform, competitive brokerage fees, and reliable customer service. Check the best mutual fund app for more. Complete the account opening process by uploading the required documents such as identity proof, address proof, and PAN card.

Step 2: Deposit funds into your trading account

After opening a demat account, you need to deposit funds to start trading. Transfer funds from your bank account to your trading account using the payment options provided by your DP. Check the demat account kya hai here. Before you start trading your business, make sure you have sufficient funds.

Read more Briansclub Cuban Renewable Energy Initiatives

Step 3: Research and Analysis

Before executing any transaction, it is important to conduct thorough research and analysis of the stocks in which you wish to invest. Using the best mutual fund app can help you all a lot. Stay informed with market news, financial reports, expert opinions, and more. We use fundamental and technical analysis to evaluate a company’s financial position, industry trends, and stock price movements. This will help you make informed investment decisions.

Step 4: Place buy and sell orders

Use your Demat account to access the online trading platform provided by DP. Go to the trading section and enter the ticker symbol or company name you want to trade. Select the appropriate order type. B. Check the demat account kya hai here. Select a market or limit order and enter the number of shares you want to buy or sell. Please confirm the contents and place your order.

Step 5: Monitor and manage your portfolio

Once you have made a transaction, it is important to monitor and manage your portfolio regularly. Track your holdings, stock prices, and market trends. Consider setting a stop-loss order to limit potential losses and maximize profits. Consider using Check the Demat account kya hai here. Review your investment strategy regularly and adjust it as market conditions change.

Step 6: Set clear financial goals

Clear financial goals are essential for successful trading. Identify your investment goals, including long-term wealth creation, short-term profits, and capital preservation. Determine your risk and set realistic profit goals. Check the demat account kya hai here. Regularly evaluate your performance against your goals and adjust your trading strategy as needed.

Step 7: Maintain discipline and knowledge

Trading on the stock market requires discipline and continuous learning. Stay up to date on market trends, economic indicators, and regulatory changes. Avoidbad trading decisions based on emotions or short-term market fluctuations. Continuously educate yourself on various trading strategies, risk management techniques, and market analysis tools or the best mutual fund app.

Step 8: Check your demat statements regularly

Your DP will provide you with regular demat statements detailing your assets, transactions, and other relevant information. Check the demat account kya hai here. Please review these statements periodically to ensure their accuracy and to identify any inconsistencies or unauthorized activities.